Your cookie preferences were saved. How to manage cookies

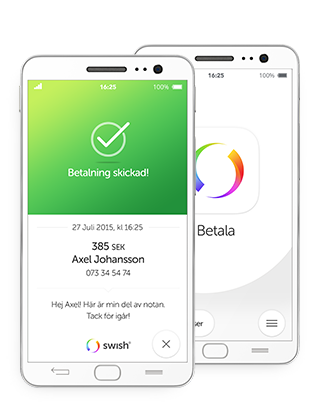

Get Swish

- Send and receive money via your mobile phone

- An easy way to make payments to private individuals, companies or associations.

- The money is sent directly – even if the recipient has a different bank

With Swish, you can quickly and securely send and receive money via your mobile phone. When you get Swish, your limit is set at SEK 3,000 per week. You can easily change your limit via the internet bank or our app.

How to get Swish

-

Download the “Swish payments” app to your mobile phone

-

Log in to our app or internet bank

-

Select “Other services” – “Swish” – “Connect new number”

-

Enter the mobile number

Enter the mobile number you want to connect to your account and click on “Get verification code”.

Enter the code that you receive via text message and click on “Continue”.

-

Select the account

Select the account you want to connect to your mobile number and choose whether you want to be able to:

“Send and receive payments” or “Receive payments only”.

-

Read and accept the terms and conditions, then click on “Continue”

-

Approve the terms and conditions with your Mobile BankID or security token

This is how Swish works

Swish is a service for sending and receiving money via a mobile device. Swish works for Android, IOS, Windows Phone 8 and tablets that support a Mobile BankID. You are required to have a Mobile BankID to make payments with Swish. This is an electronic ID for smart phones and tablets.

To get Swish

- Order Swish in the Internet Bank or the app.

- Download Swish betalningar and BankID säkerhetsapp to your mobile device or tablet.

Price

SEK 0 for private individuals.